Access to working capital enables companies of all types to avoid operational disturbances in the short term and power growth for the long term. Use of these solutions is skyrocketing among Growth Corporates in the fleet and mobility industry.

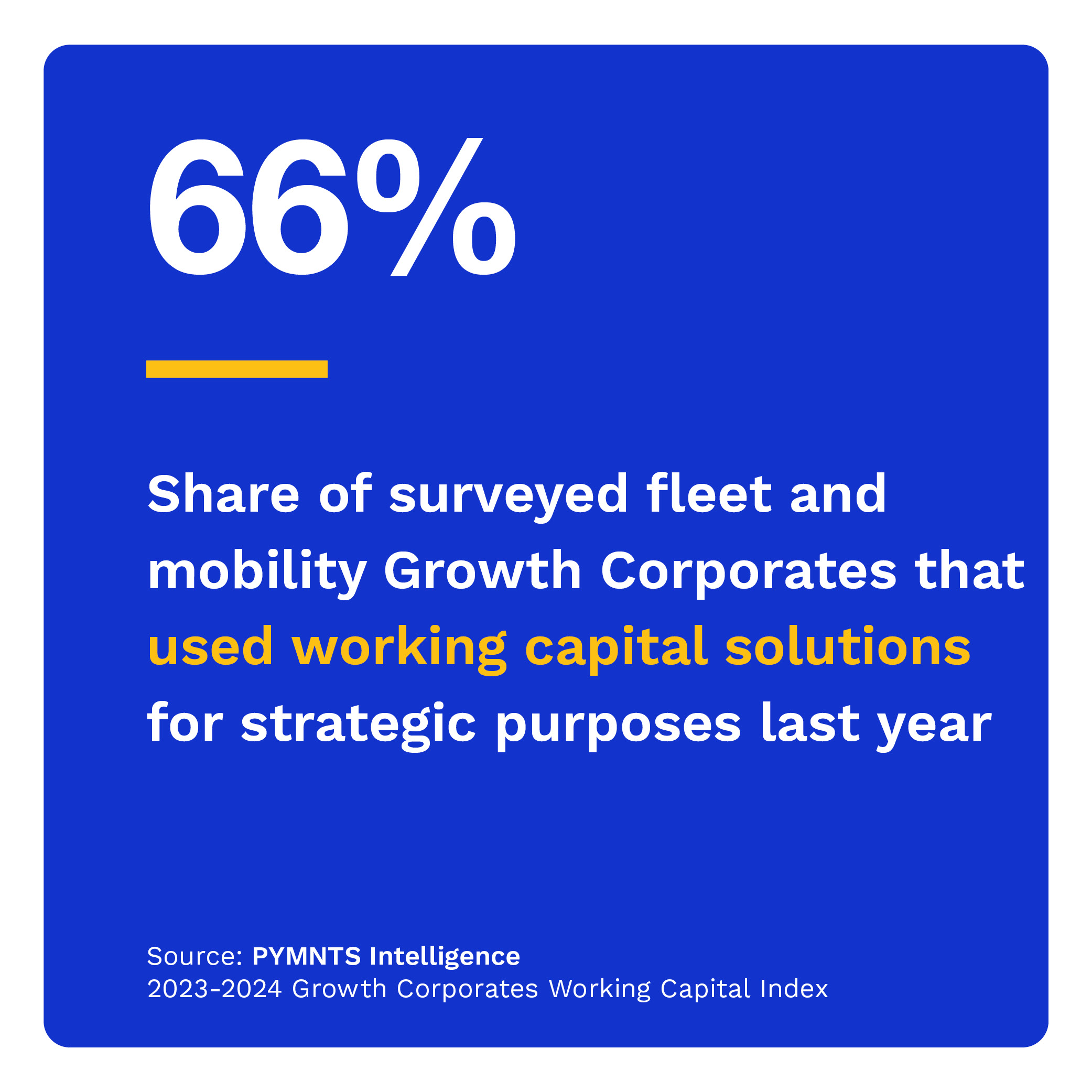

Two-thirds of Growth Corporates in the fleet and mobility industry used working capital solutions in 2023, a share expected to grow in 2024. Key reasons for using these include filling in for seasonal liquidity shortfalls, investing in assets and upgrading legacy systems. The increasing optimism in this sector represents a clear opportunity to cater to companies with less predictable cash flows, especially in Central Europe, the Middle East and Africa (CEMEA) and North America.

Two-thirds of Growth Corporates in the fleet and mobility industry used working capital solutions in 2023, a share expected to grow in 2024. Key reasons for using these include filling in for seasonal liquidity shortfalls, investing in assets and upgrading legacy systems. The increasing optimism in this sector represents a clear opportunity to cater to companies with less predictable cash flows, especially in Central Europe, the Middle East and Africa (CEMEA) and North America.

These are some of the findings explored in “2023-2024 Growth Corporates Working Capital Index: Fleet and Mobility Edition,” a PYMNTS Intelligence and VISA collaboration. This report analyzes the working capital needs of companies in the fleet and mobility industry generating between $50 million and $1 billion in revenues. This edition draws on a telephone survey of 151 Growth Corporates across five regions conducted between March 9, 2023, and June 12, 2023.

Other findings from the report include:

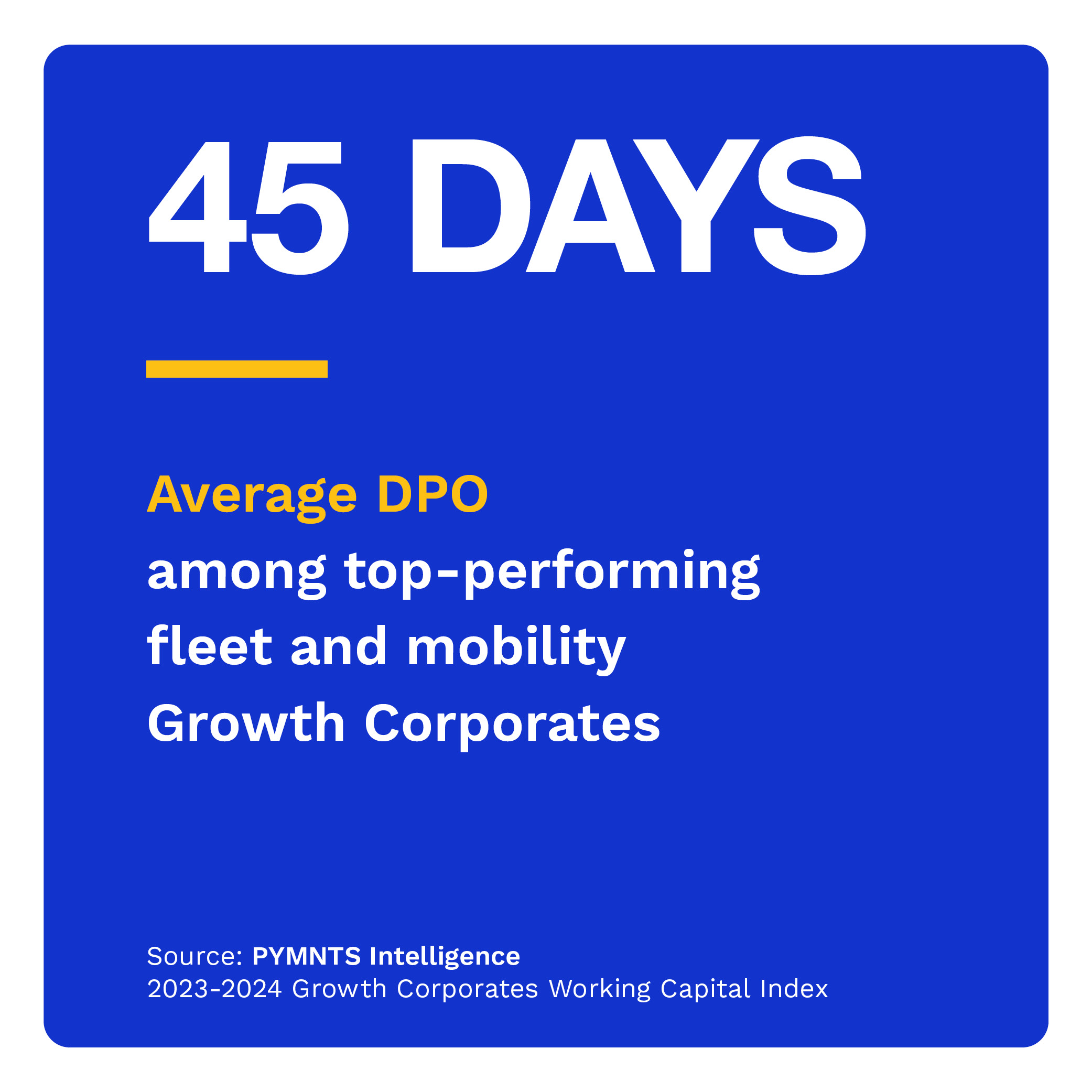

Top performers stand out because they are likely to know when their next liquidity shortfall is coming up. Knowing this enables the companies to best deploy external working capital. Another standout aspect of top performers is their aligned stance in focusing on strategic investment: 94% use working capital solutions to finance investments and other growth initiatives.

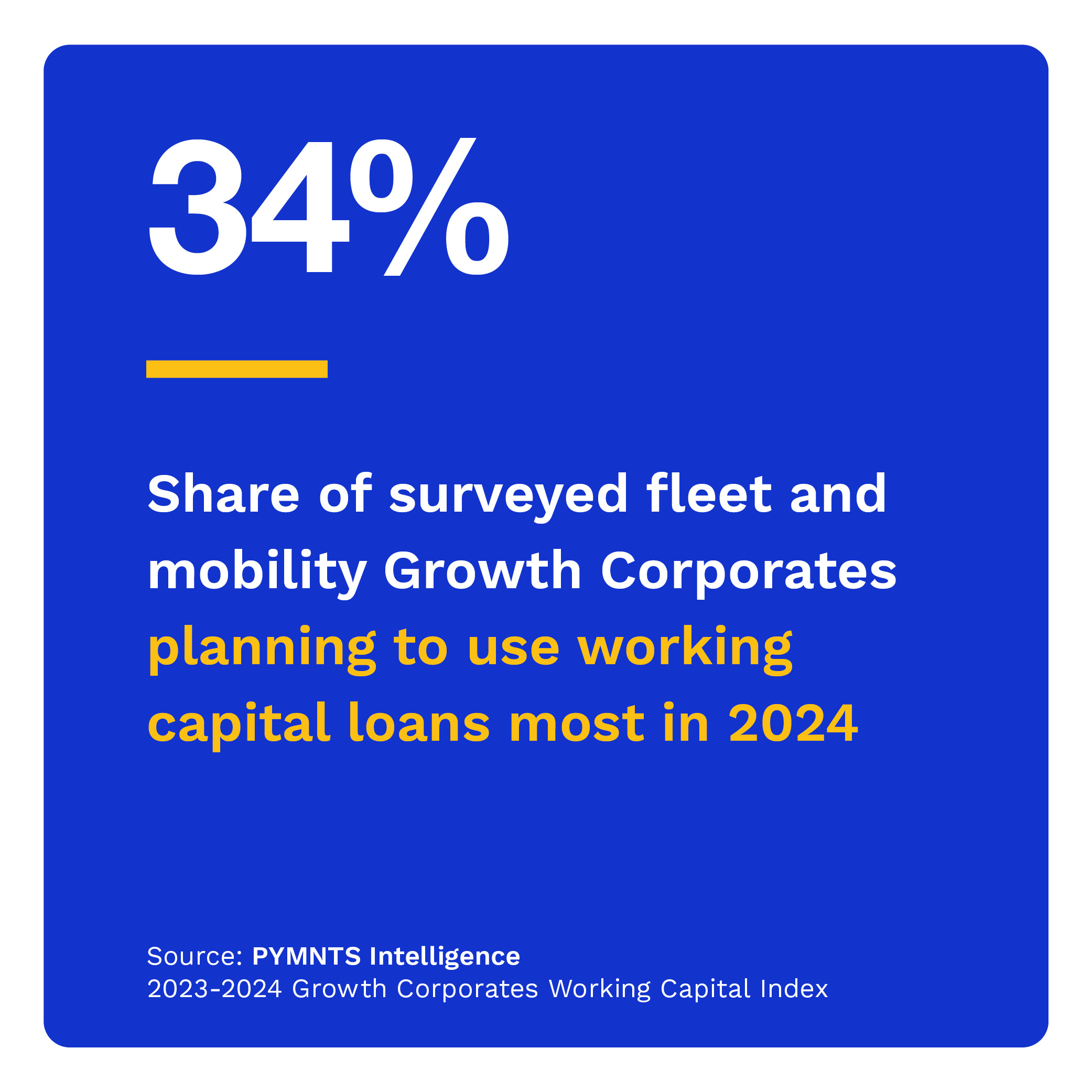

Growth Corporates in this sector have an optimistic economic outlook, meaning many expect to become working capital users this year. This sector expects a 17% increase in projected users, with a slight inclination toward bank lines of credit/guarantees, invoice financing and corporate overdrafts.

The fleet and mobility sector is the only segment where some regions’ virtual card use is down. The sector, overall, has the second-lowest projected use rate for virtual cards. Nonetheless, fleet and mobility firms in CEMEA and North America are turning to virtual cards at notable rates.

A robust sense of economic optimism drives the fleet and mobility sector to bolster its use of working capital solutions to address planned growth objectives. There are clear opportunities for external working capital solution providers to cater to the fleet and mobility segment, particularly those serving North America and CEMEA.

Download the report to learn more about how the fleet and mobility industry is leveraging working capital solutions.